Global Economic Outlook: Key Factors Influencing Markets in 2025

Introduction

As we navigate through 2025, the global economy stands at a crossroads, influenced by a confluence of factors ranging from geopolitical tensions to technological advancements. Understanding these dynamics is crucial for investors, policymakers, and businesses aiming to make informed decisions in an increasingly complex financial landscape.

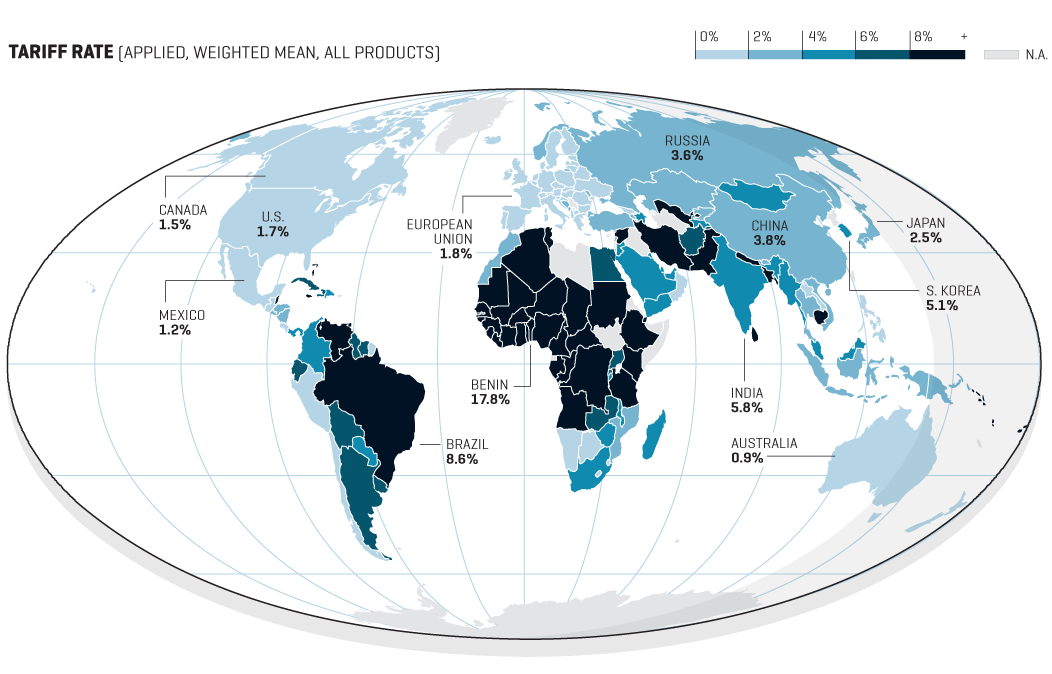

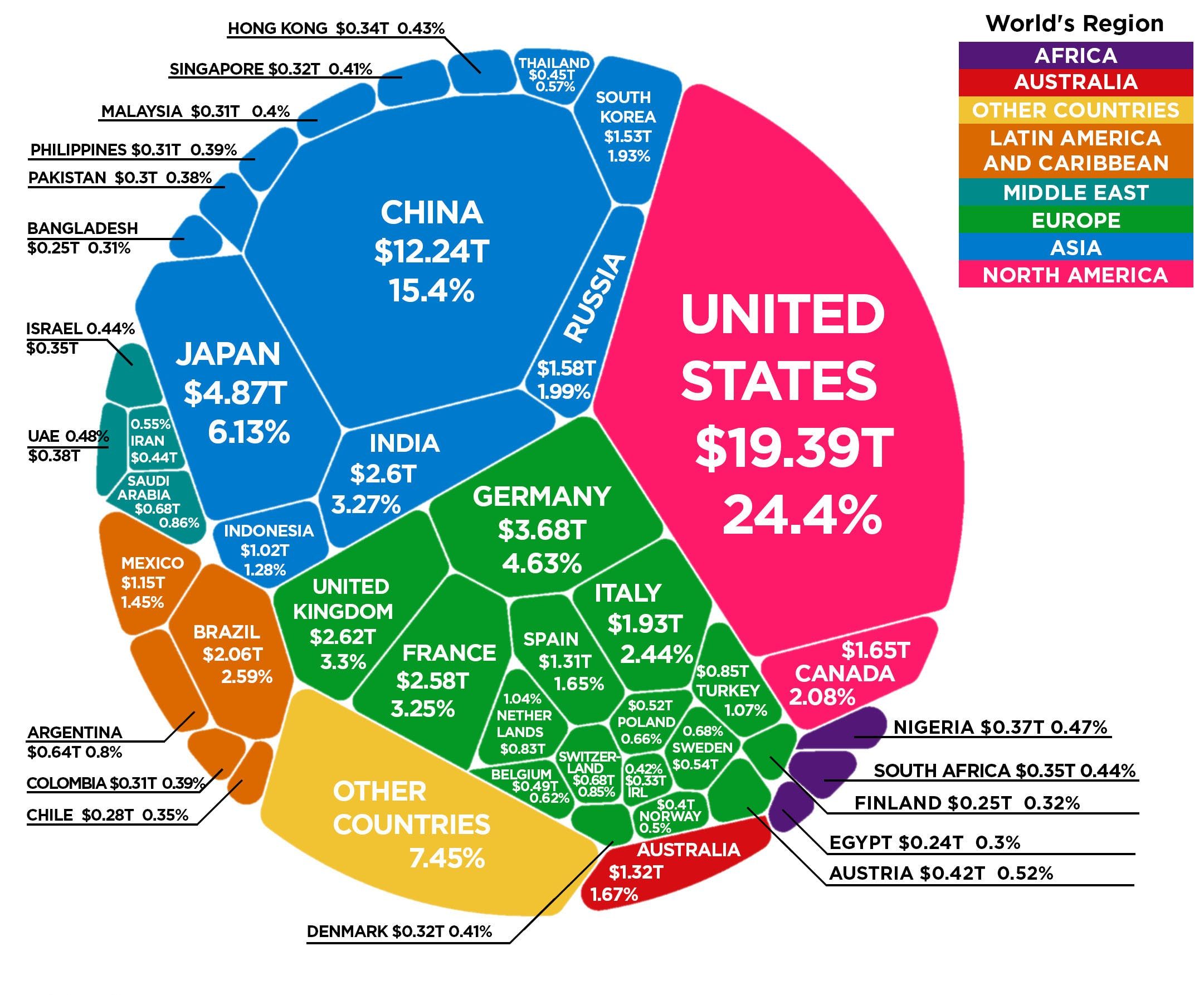

📉 Slowing Global Growth Amid Trade Tensions

The International Monetary Fund (IMF) has revised its global growth forecast for 2025 downward to 2.8%, citing escalating trade tensions and policy uncertainties as primary contributors to the slowdown. The imposition of sweeping tariffs by the United States has disrupted global trade flows, leading to decreased investment and heightened market volatility.

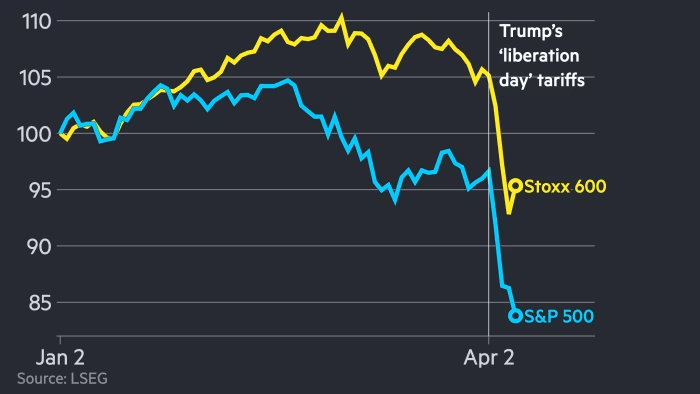

🇺🇸 U.S. Economic Policy and Market Volatility

In the United States, aggressive trade policies have led to significant market fluctuations. The introduction of broad tariffs has not only strained international relations but also contributed to a stock market downturn, with major indices experiencing their most substantial declines since the COVID-19 pandemic. These developments have raised concerns about a potential recession and the long-term impact on the U.S. economy.

🌐 Emerging Markets Facing Debt Challenges

Emerging and developing economies are grappling with increasing debt burdens exacerbated by reduced foreign investment and higher borrowing costs. The World Bank has highlighted that debt servicing costs in some low-income countries have surged, consuming up to 20% of GDP and limiting expenditures on critical sectors like health and education. These challenges underscore the need for structural reforms and international support to ensure sustainable growth.

🏭 Technological Advancements and Market Disruption

Technological innovation, particularly in artificial intelligence and automation, continues to reshape industries and labor markets. While these advancements offer opportunities for increased productivity and new business models, they also pose challenges related to job displacement and regulatory frameworks. Investors are closely monitoring sectors poised for disruption to identify potential growth areas and mitigate risks.

Technological innovation, particularly in artificial intelligence and automation, continues to reshape industries and labor markets. While these advancements offer opportunities for increased productivity and new business models, they also pose challenges related to job displacement and regulatory frameworks. Investors are closely monitoring sectors poised for disruption to identify potential growth areas and mitigate risks.

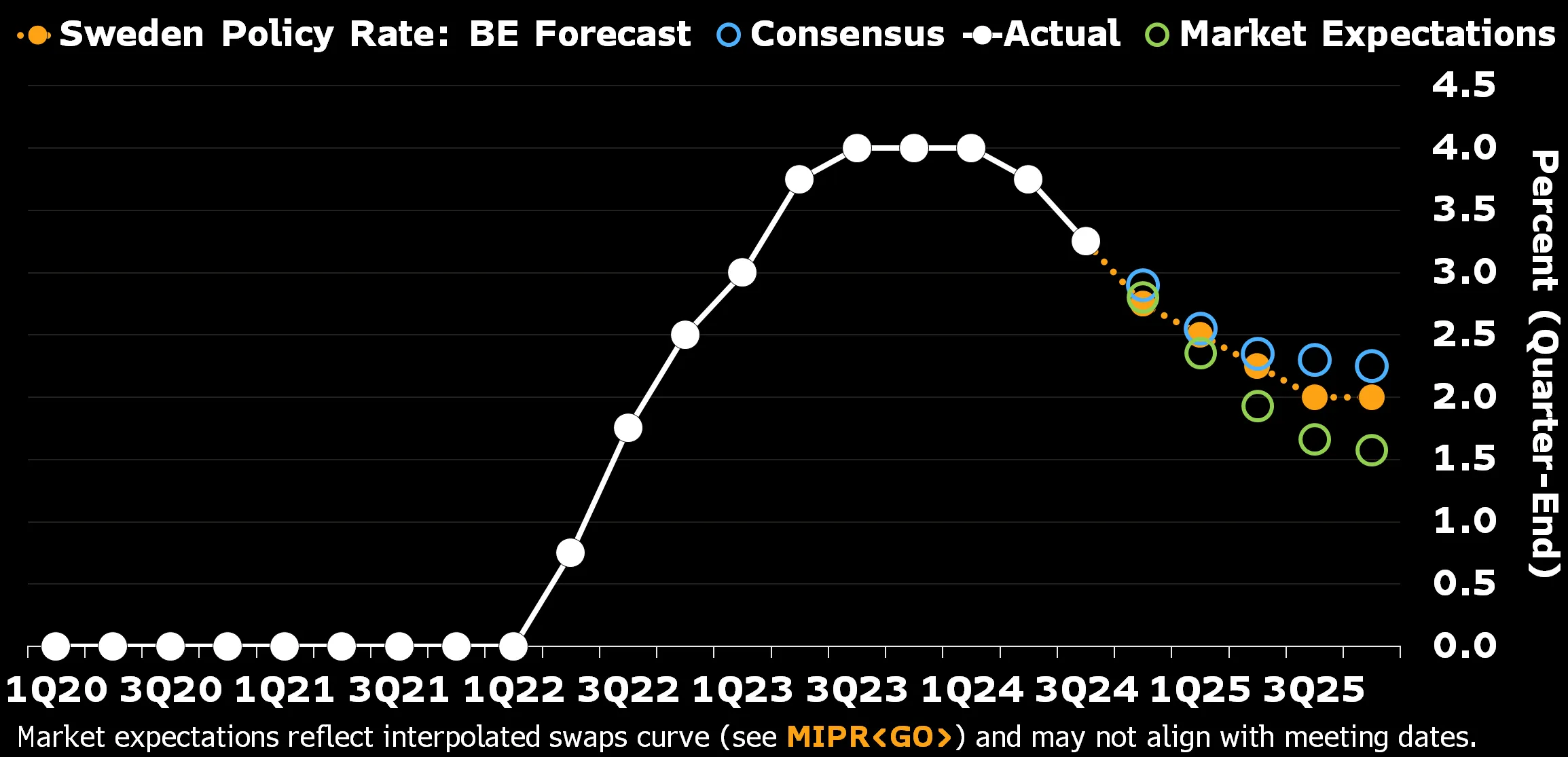

🏦 Central Bank Policies and Inflation Dynamics

Central banks worldwide are navigating a delicate balance between controlling inflation and supporting economic growth. In the U.S., the Federal Reserve’s interest rate decisions are under scrutiny as inflationary pressures persist amid slowing growth. Globally, monetary policy divergence is influencing capital flows and exchange rates, adding complexity to investment strategies.

Central banks worldwide are navigating a delicate balance between controlling inflation and supporting economic growth. In the U.S., the Federal Reserve’s interest rate decisions are under scrutiny as inflationary pressures persist amid slowing growth. Globally, monetary policy divergence is influencing capital flows and exchange rates, adding complexity to investment strategies.

Final Thoughts

The global economic landscape in 2025 is marked by uncertainty and transformation. Trade policies, technological advancements, and monetary strategies are interwoven factors influencing market trajectories. Stakeholders must remain agile, informed, and collaborative to navigate these challenges and capitalize on emerging opportunities.

editor's pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua