How to Maximize Your Credit Card Benefits: Tips and Trick

Introduction

A credit card isn’t just a payment tool—it can be a powerful ally in your financial journey. From cashback and travel points to purchase protections and exclusive perks, credit cards offer more than most people realize.

In this article, we’ll show you how to unlock your card’s full potential with simple, effective strategies to earn more rewards, save on fees, and protect your purchases—without falling into debt.

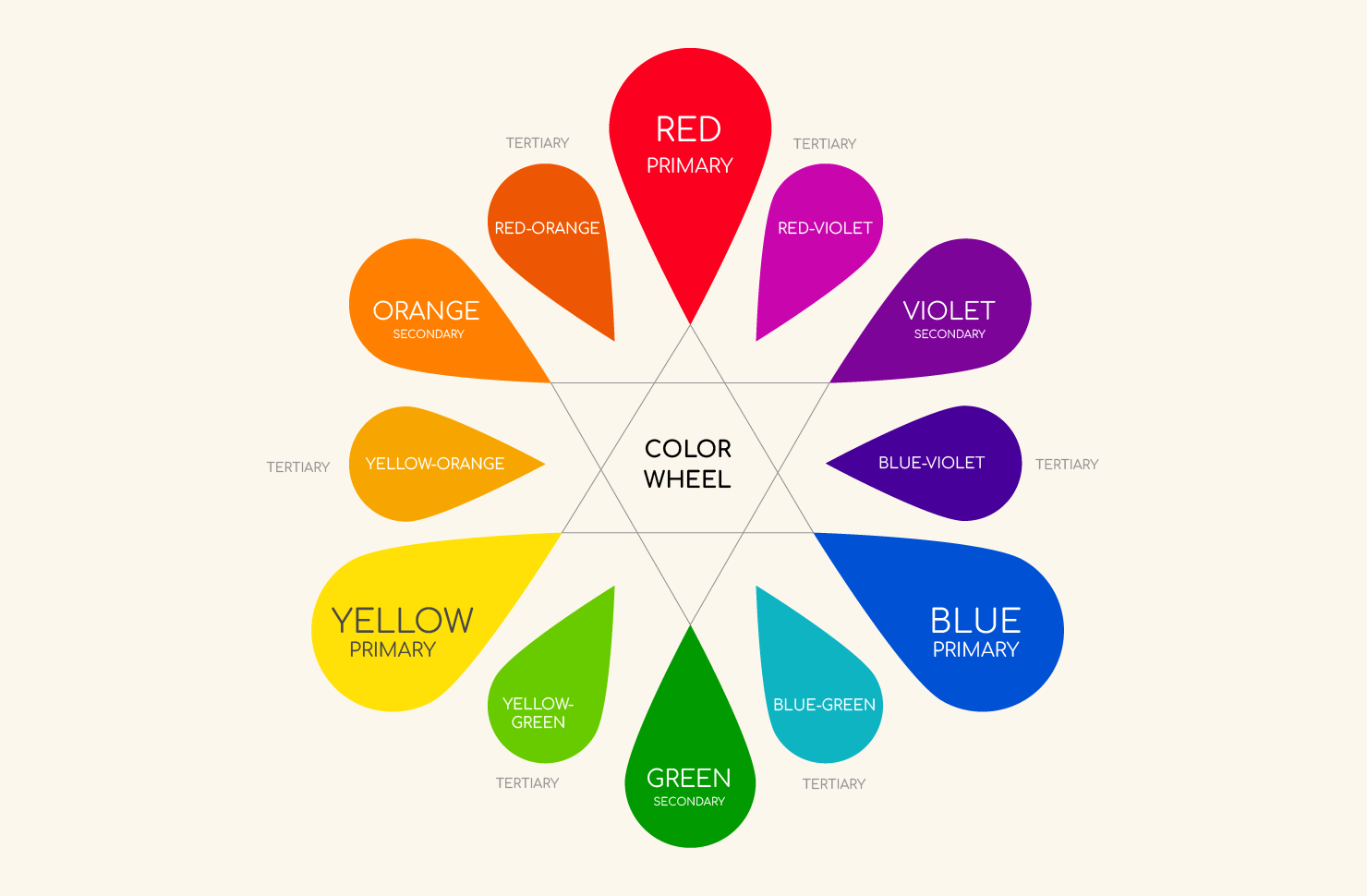

💰 1. Know Your Card’s Rewards Categories

Most cards have bonus categories like dining, groceries, gas, or travel—and rewards can be 2x, 5x, or more in those areas.

What You Should Do:

-

Review your card’s earning structure

-

Adjust your spending habits to align with high-reward categories

-

Use different cards for different types of purchases (if you have more than one)

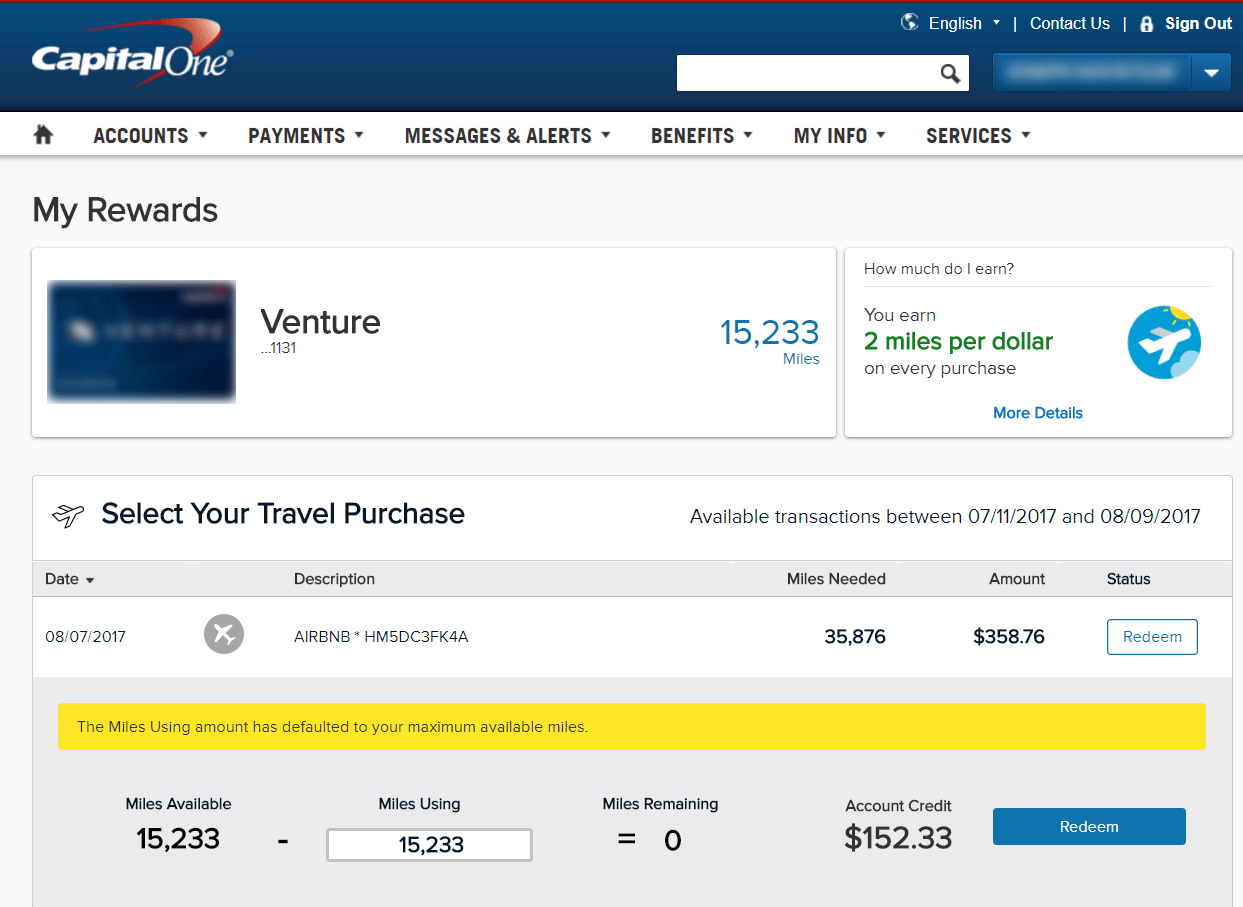

🧾 2. Use Every Dollar to Earn Rewards

Don’t just reserve your card for big purchases. Use it for everyday essentials like streaming subscriptions, utilities, and even insurance payments—wherever cards are accepted without extra fees.

Bonus Tip: Set up recurring bills on your card to automatically earn rewards while simplifying your monthly payments.

🎯 3. Take Advantage of Sign-Up Bonuses

Introductory offers can be the fastest way to rack up points or cashback—but they require strategic timing and planning.

How to Maximize It:

-

Apply when you have upcoming large expenses

-

Track your spending to hit the required minimum within the time frame

-

Don’t overspend just to earn the bonus—it defeats the purpose!

📸 [Image suggestion: Progress tracker graphic for reaching a sign-up bonus milestone]

🛍️ 4. Stack Rewards with Portals & Cashback Sites

Many cards offer shopping portals where you can earn bonus rewards on top of your card’s usual points. Add a cashback site like Rakuten, and you can double-dip.

Pro Tips:

-

Start your shopping at your card’s portal (e.g., Chase Ultimate Rewards, Amex Offers)

-

Combine this with coupon codes and cashback apps for maximum value

-

Bookmark your favorite merchant links

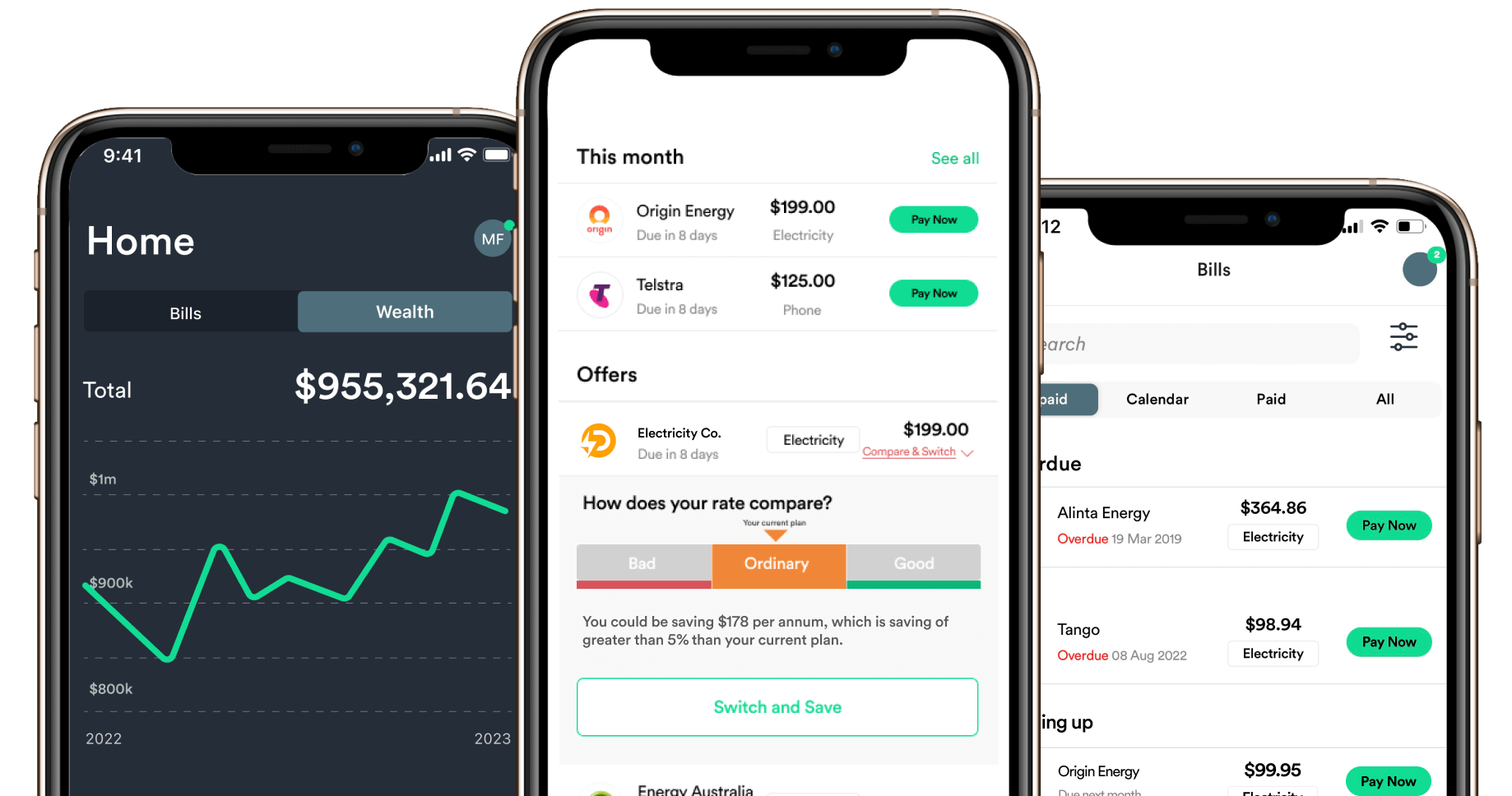

📉 5. Avoid Interest at All Costs

No amount of rewards is worth paying high interest. To truly benefit from your card:

-

Always pay your balance in full and on time

-

Set up auto-pay or calendar reminders

-

Use a budgeting app to stay on top of spending

🧳 6. Explore Travel Perks and Protections

Many cards offer hidden travel benefits—even some with no annual fee.

Look for perks like:

-

Trip delay and baggage insurance

-

Car rental coverage

-

Airport lounge access

-

No foreign transaction fees

🛡️ 7. Use Purchase Protections & Extended Warranties

Some cards go beyond rewards by offering return protection, fraud coverage, and extended warranties—automatically.

Check your card’s fine print for:

-

Price protection if an item drops in price

-

Reimbursement for lost or stolen goods

-

Coverage for repairs after the manufacturer’s warranty expires

📝 Final Thoughts

Maximizing your credit card benefits isn’t about spending more—it’s about being smart with how you spend. When used wisely, your credit card can reward you with free travel, cashback, purchase security, and peace of mind.

Use these tips to make the most of what you already have in your wallet—and turn everyday purchases into long-term perks.

editor's pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua