Investing for Beginners: How to Start Building Wealth Today

Introduction

If you’ve ever wondered how to build real wealth over time, investing is the answer. It’s one of the most powerful tools to grow your money—yet many people delay getting started because they think it’s too complicated, risky, or only for the rich.

The truth is: you don’t need a finance degree or thousands of dollars to begin investing. With the right guidance, anyone can get started—and the sooner, the better. In this beginner’s guide, we’ll walk you through the basics of investing and how to take your first steps toward financial freedom.

🧠 Why You Should Start Investing Now

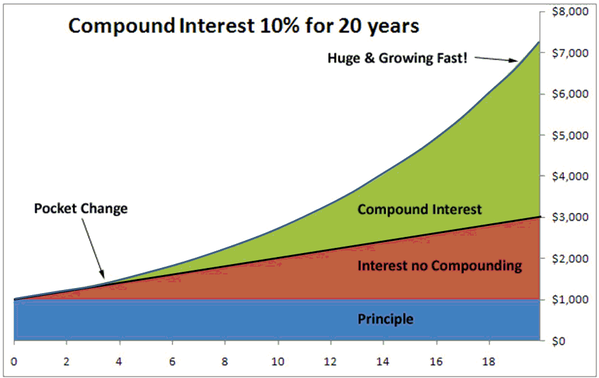

Investing allows your money to work for you by earning returns over time. Thanks to compound interest, even small amounts invested consistently can grow into significant wealth.

Key Benefits:

-

Builds long-term wealth

-

Beats inflation

-

Helps you reach financial goals (retirement, home, freedom)

-

Creates passive income streams

💸 Step 1: Understand the Basics of Investing

At its core, investing is putting your money into assets that can grow in value or generate income. These include:

-

Stocks – Ownership in companies

-

Bonds – Loans to governments or corporations

-

Mutual Funds & ETFs – Diversified baskets of investments

-

Real Estate – Physical properties or REITs

-

Index Funds – Low-fee funds tracking the market

Beginner Tip: Start with broad, diversified funds like ETFs or index funds to reduce risk.

🎯 Step 2: Define Your Investment Goals

Ask yourself: What am I investing for?

-

Retirement

-

Buying a home

-

Children’s education

-

Financial independence

Knowing your goals helps determine your investment timeline and risk tolerance—two critical factors when choosing where to invest.

🛠️ Step 3: Choose Your Investment Account

To invest, you’ll need the right account. Here are a few options:

-

Brokerage Account: Taxable, flexible, ideal for general investing

-

Retirement Accounts: Like a 401(k), RRSP (Canada), or IRA—tax-advantaged

-

Robo-Advisors: Automated platforms that build and manage a portfolio for you (e.g., Wealthsimple, Betterment)

📈 Step 4: Start Small and Stay Consistent

You don’t need a fortune to begin. Start with what you can afford—even $50/month adds up over time.

Pro Tips:

-

Use automatic contributions to stay consistent

-

Reinvest your dividends to grow faster

-

Avoid timing the market—invest regularly instead

Beginner-Friendly Strategy: Dollar-cost averaging (investing the same amount regularly regardless of market ups and downs)

🧘 Step 5: Keep It Simple & Stay the Course

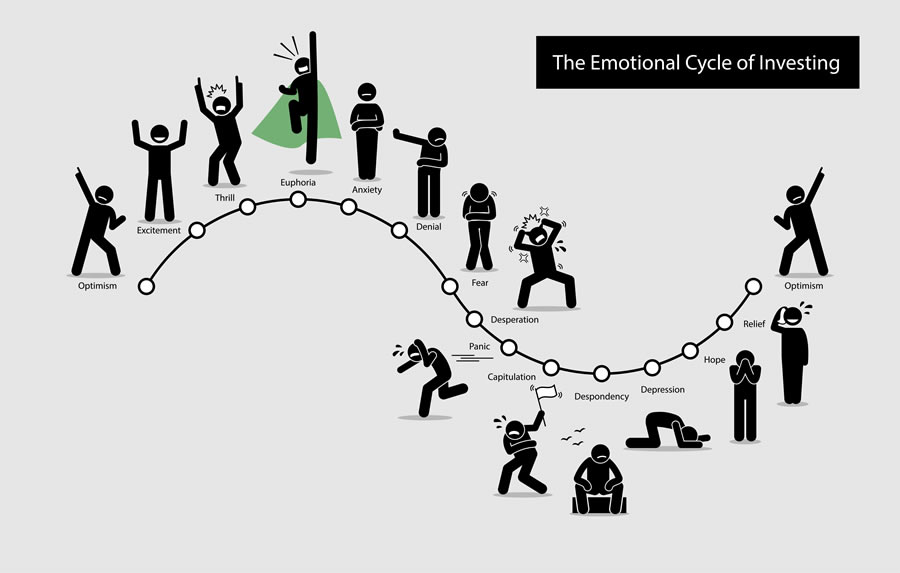

Investing success comes from patience and discipline, not constant tweaking.

Do This:

-

Focus on long-term growth

-

Don’t panic during market dips

-

Review your portfolio yearly—not daily

Avoid This:

-

Chasing hot stocks or trends

-

Trying to time the market

-

Making decisions based on emotion

🧠 Final Thoughts

Investing isn’t about getting rich overnight—it’s about building wealth slowly, safely, and smartly. The earlier you start, the more time your money has to grow.

So don’t wait until you feel “ready.” Start now, start small, and stick with it. Your future self will thank you.

editor's pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua