Life Insurance 101: Choosing the Right Policy for Your Family

Introduction

Life insurance isn’t just about death—it’s about peace of mind for the living. It ensures that your loved ones are financially protected if something happens to you, giving them stability during life’s most difficult moments.

But choosing the right policy can be confusing. With so many terms and options, how do you know what your family truly needs? In this guide, we’ll break down the basics of life insurance so you can confidently select the right plan to protect what matters most.

💡What Is Life Insurance and Why Do You Need It?

Life insurance provides a lump-sum payment (called a death benefit) to your beneficiaries if you pass away. It helps your family cover:

-

Funeral costs

-

Mortgage or rent

-

Daily living expenses

-

Debts, loans, or credit cards

-

Future costs like college or childcare

🧾 The Two Main Types of Life Insurance

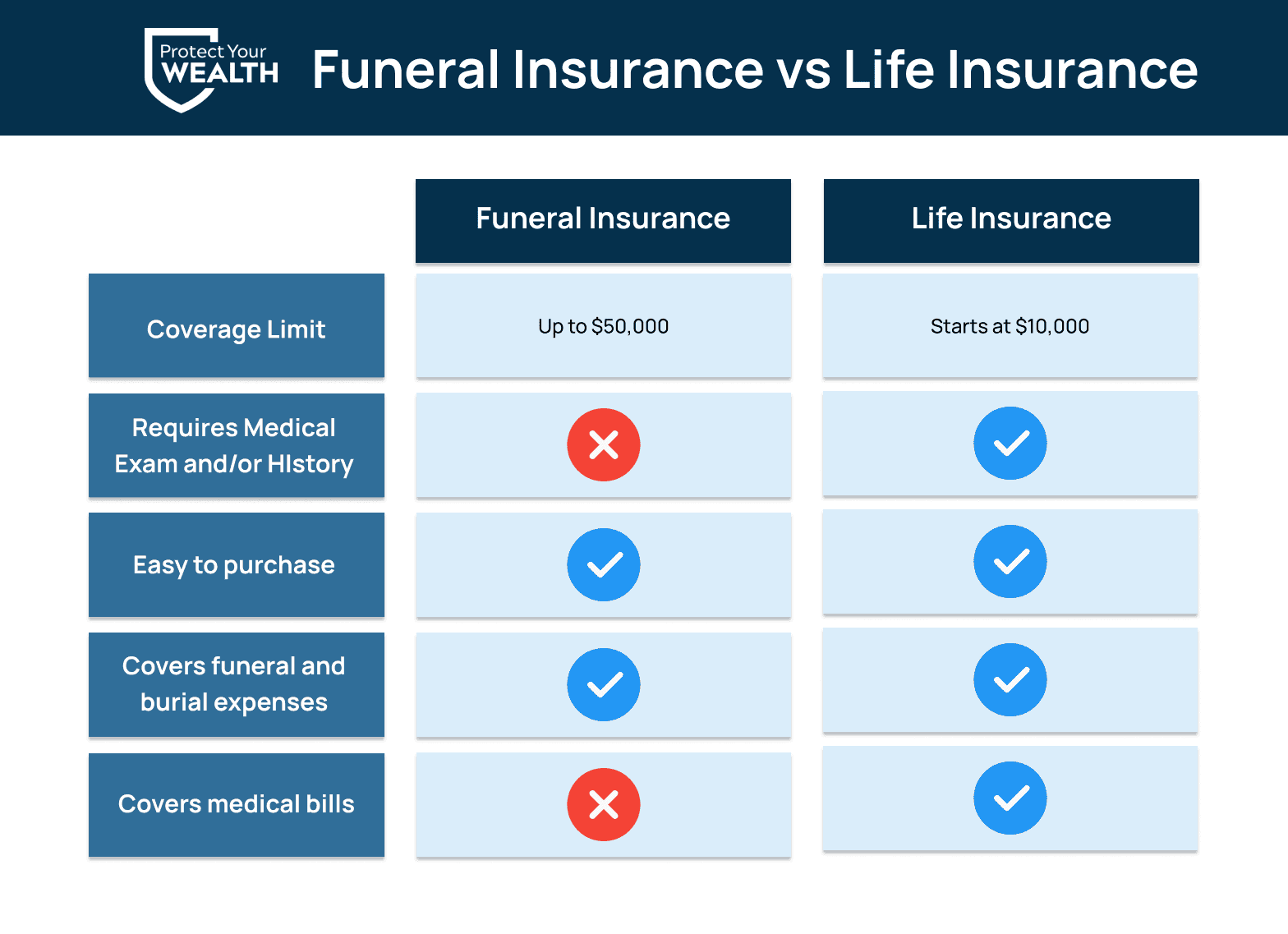

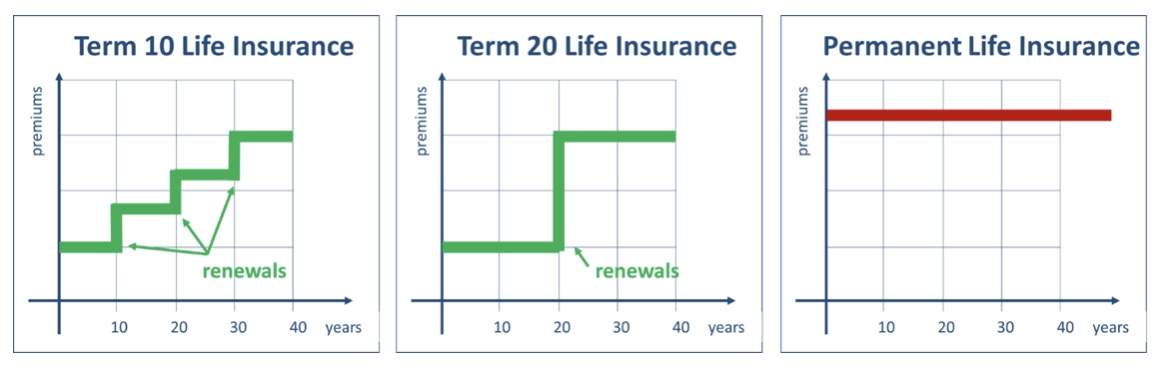

1. Term Life Insurance – Affordable, Straightforward Coverage

Term life insurance provides coverage for a set number of years (typically 10, 20, or 30). If you die during the term, your beneficiaries receive the death benefit.

Pros:

-

Most affordable option

-

Great for young families and homeowners

-

Easy to understand

-

Can be converted to permanent coverage later (in some plans)

Cons:

-

No payout if you outlive the term

-

No investment or cash value

2. Whole Life (Permanent) Insurance – Lifetime Protection + Cash Value

Whole life provides coverage for your entire life, as long as premiums are paid. It also builds cash value over time, which you can borrow against or use later in life.

Pros:

-

Guaranteed payout regardless of age

-

Builds cash value

-

Can be used as part of long-term financial planning

Cons:

-

Significantly more expensive than term

-

Less flexibility in coverage and investment options

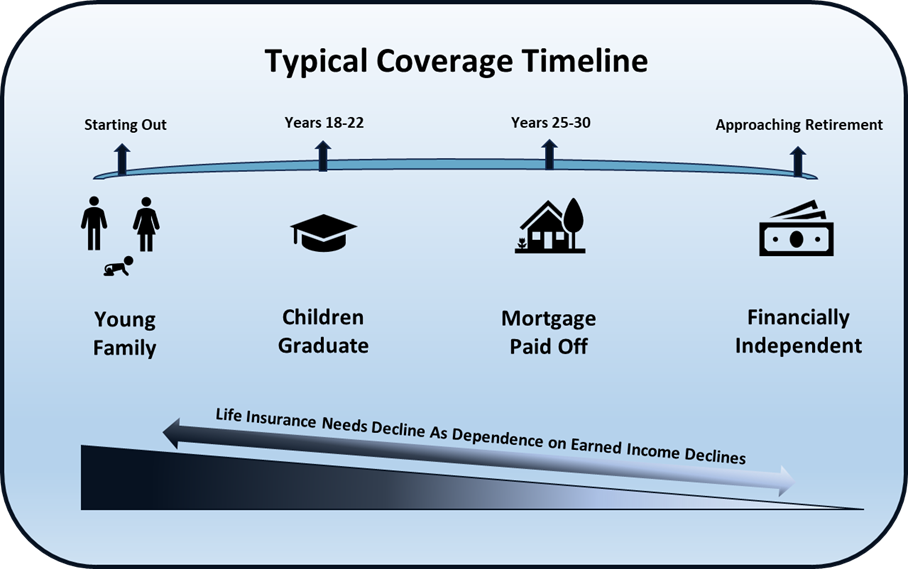

👨👩👧👦 How to Choose the Right Policy for Your Family

When choosing a life insurance policy, ask yourself:

-

How much does your family rely on your income?

-

What expenses would need to be covered if you’re gone?

-

Do you want just protection, or a financial tool with savings?

-

How long do you need the coverage for?

General Rule of Thumb:

Aim for coverage that equals 10–15x your annual income to fully protect your loved ones.

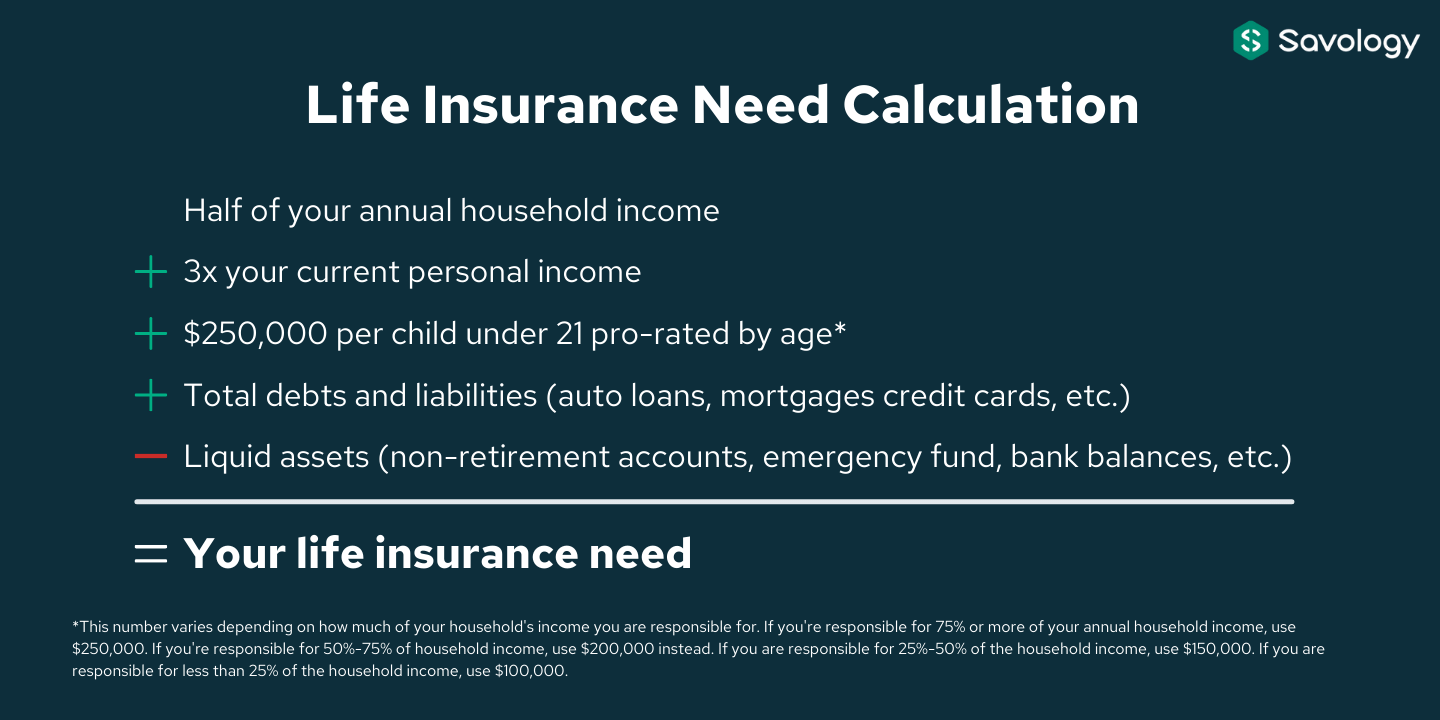

🧮 Estimating Your Coverage Needs

Here’s a simple way to calculate your life insurance needs:

📝 What to Look for in a Policy

-

Affordable monthly premiums

-

Reliable insurance company with a solid track record

-

Renewability options (especially for term plans)

-

Convertible features (term to whole life flexibility)

-

Riders such as accidental death, disability waiver, or child protection

⚠️ Common Mistakes to Avoid

-

Delaying coverage because you’re “young and healthy”

-

Choosing the cheapest policy without understanding the trade-offs

-

Underinsuring (not accounting for long-term family needs)

-

Forgetting to update your beneficiaries

Final Thoughts ❤️

Life insurance is a gift of security, stability, and love. Whether you choose a term or whole policy, the most important step is starting the conversation and getting covered before it’s too late. Your family’s future deserves that protection.

editor's pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua