The Rise of Digital Currencies: What It Means for the Future of Finance

Introduction

Digital currencies are no longer a futuristic concept—they are rapidly becoming a central component of the global financial landscape. From Central Bank Digital Currencies (CBDCs) to stablecoins and decentralized cryptocurrencies, these innovations are reshaping how we think about money, payments, and economic sovereignty. As we progress through 2025, understanding the implications of this digital transformation is crucial for individuals, businesses, and governments alike.

🏦 Central Bank Digital Currencies (CBDCs): A New Era of Monetary Policy

Central banks worldwide are exploring or implementing CBDCs to modernize payment systems, enhance financial inclusion, and maintain monetary sovereignty. For instance, the European Central Bank is advancing its digital euro project, aiming to provide a secure and efficient digital payment option for the eurozone. Similarly, China’s digital yuan has seen widespread adoption, positioning the country as a leader in digital currency implementation. These developments signify a shift towards more centralized digital monetary systems, with potential benefits and challenges for global finance.

💳 Stablecoins: Bridging Traditional Finance and Digital Innovation

Stablecoins, digital currencies pegged to stable assets like the U.S. dollar, are gaining traction as a means to facilitate faster and more efficient transactions. Companies like PayPal have introduced their own stablecoins, such as PYUSD, to streamline digital payments and reduce transaction costs. These developments indicate a growing integration of stablecoins into mainstream financial services, offering a bridge between traditional banking and emerging digital finance.

Stablecoins, digital currencies pegged to stable assets like the U.S. dollar, are gaining traction as a means to facilitate faster and more efficient transactions. Companies like PayPal have introduced their own stablecoins, such as PYUSD, to streamline digital payments and reduce transaction costs. These developments indicate a growing integration of stablecoins into mainstream financial services, offering a bridge between traditional banking and emerging digital finance.

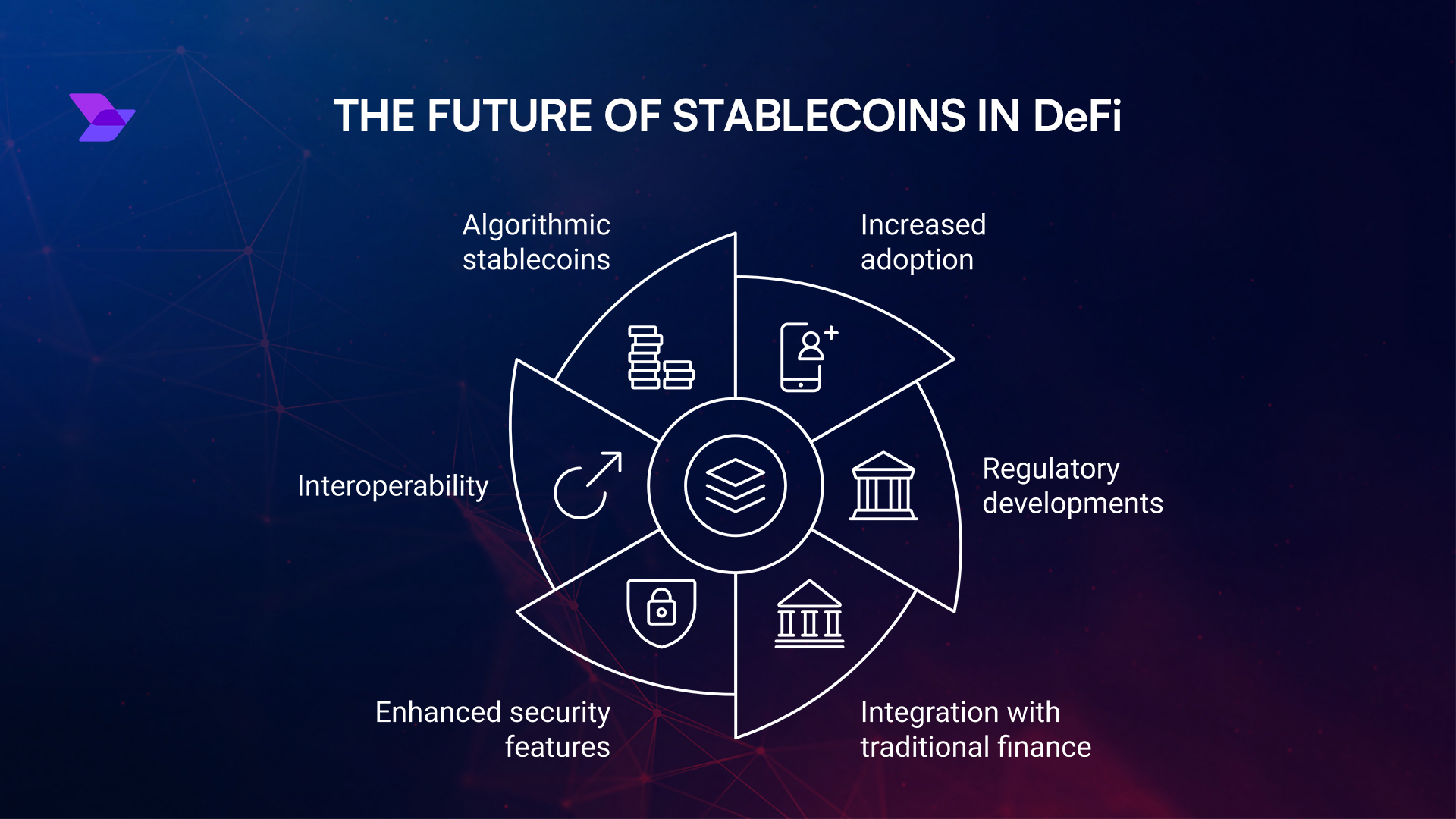

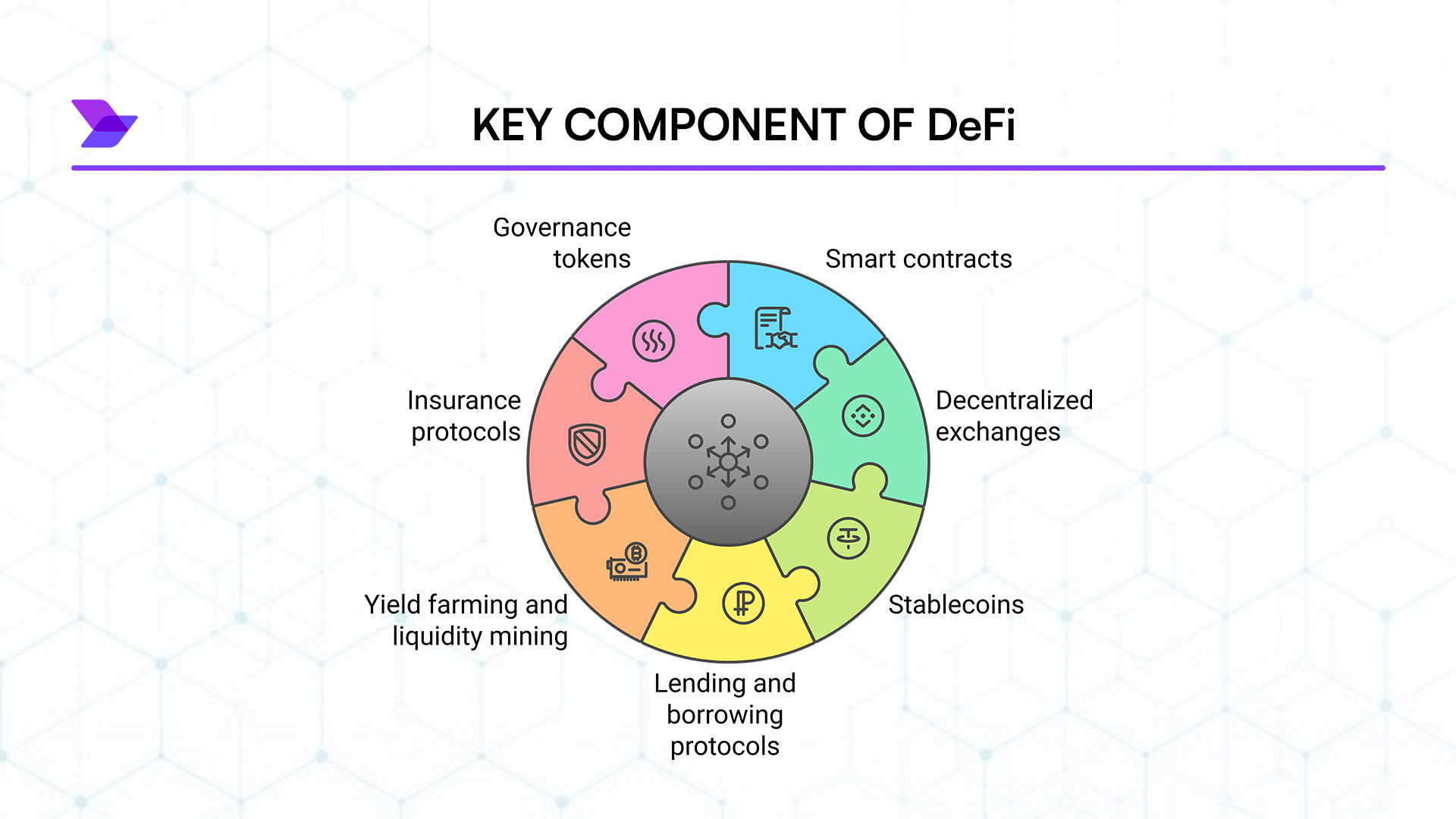

🌐 Decentralized Finance (DeFi): Redefining Financial Services

Decentralized Finance, or DeFi, leverages blockchain technology to offer financial services without traditional intermediaries. Platforms enable users to lend, borrow, and trade assets directly, fostering a more inclusive and accessible financial ecosystem. While DeFi presents opportunities for innovation and financial empowerment, it also poses regulatory and security challenges that need to be addressed to ensure sustainable growth.

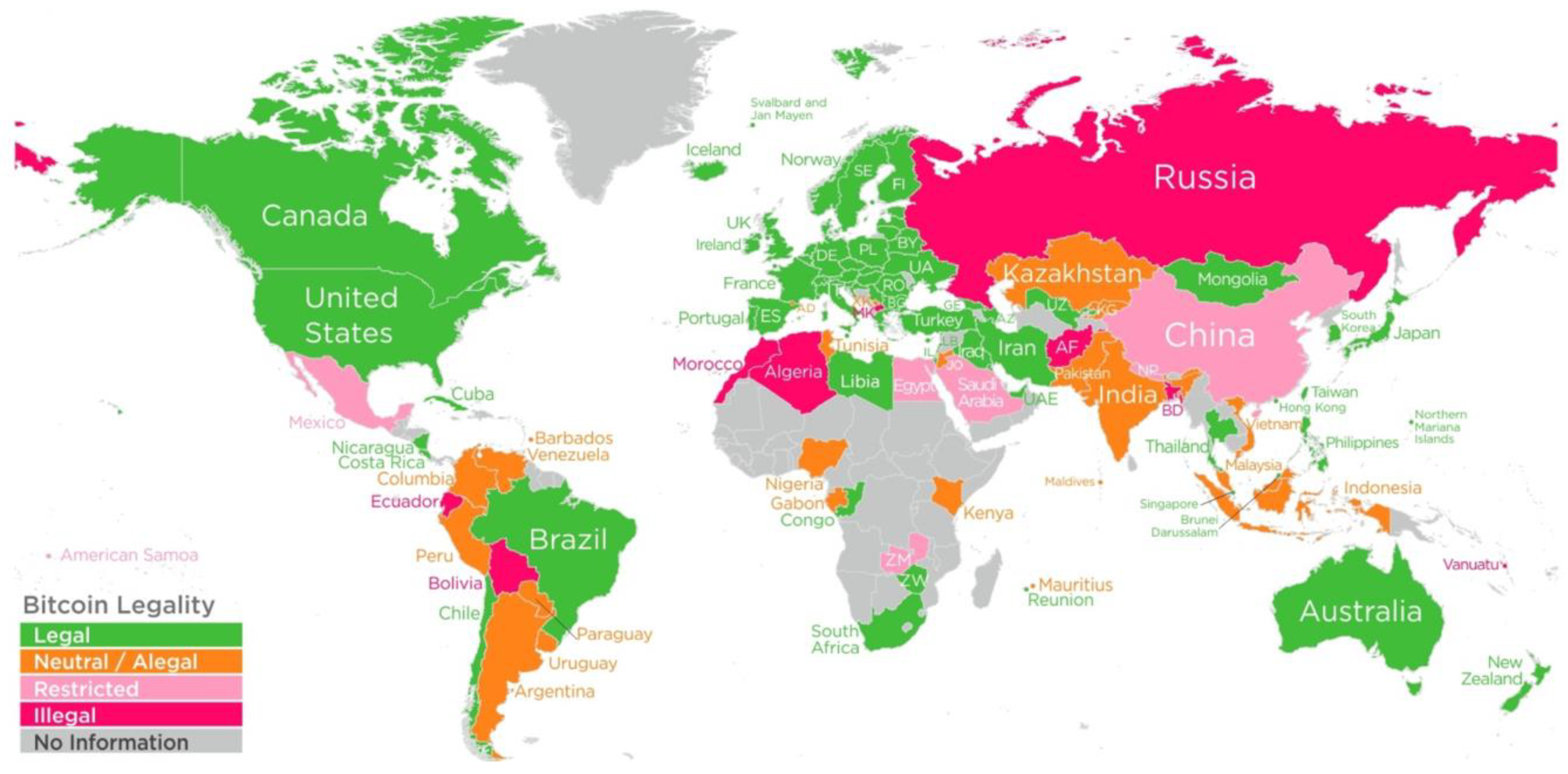

🛡️ Regulatory Landscape: Navigating the Digital Currency Frontier

As digital currencies proliferate, regulatory frameworks are evolving to address issues of security, compliance, and consumer protection. Governments and financial authorities are working to establish guidelines that balance innovation with risk management. For example, recent legislative efforts in various countries aim to define the legal status of digital assets and implement measures to prevent illicit activities. These regulatory developments are critical in shaping the future trajectory of digital currencies and ensuring their integration into the global financial system.

🔮 Future Outlook: Embracing the Digital Financial Revolution

The rise of digital currencies signifies a transformative period in financial history. As technology continues to evolve, we can anticipate further innovations that will redefine how we conduct transactions, store value, and perceive money itself. Embracing this digital financial revolution requires adaptability, informed decision-making, and a proactive approach to understanding the implications of these emerging technologies.

Final Thoughts

Digital currencies are reshaping the financial landscape, offering new opportunities and challenges. As we navigate this evolving terrain, staying informed and adaptable is key to leveraging the benefits of digital finance while mitigating potential risks. The future of finance is digital, and understanding its dynamics is essential for participating in the global economy of tomorrow.

editor's pick

news via inbox

Nulla turp dis cursus. Integer liberos euismod pretium faucibua